Here we will discuss these aspects of NAICS codes-

- What is NAICS Code?

- What Is the Purpose of NAICS Codes?

- What Is the Distinction between a NAICS and a SIC Code?

- How to Perform a NAICS Lookup?

- The Structure of NAICS Codes

- How to Modify Your NAICS Code?

- Is it legal to have more than one primary NAICS code?

Contact Us for Marketing Campaigns

What is NAICS Code?

North American Industrial Classification System codes, or "NAICS codes," are six-digit numbers that categorize businesses into specific industry sectors. Each digit represents a separate classification for your company. The initial two digits of a NAICS code lookup represent a business's principal group or sector. These two numerals define 20 separate industrial sectors. The final four digits are used to categorize further subsectors, industry groupings, industry types, and industries by country. The NAICS code search system was created to help government agencies track economic activity.

| NAICS Code |

Description |

Total Marketable Businesses |

| 11 |

Agriculture, Forestry, Fishing and Hunting |

367,824 |

| 21 |

Mining |

32,268 |

| 22 |

Utilities |

48,626 |

| 23 |

Construction |

1,514,282 |

| 31-33 |

Manufacturing |

657,322 |

| 42 |

Wholesale Trade |

697,201 |

| 44-45 |

Retail Trade |

1,818,112 |

| 48-49 |

Transportation and Warehousing |

656,665 |

| 51 |

Information |

370,887 |

| 52 |

Finance and Insurance |

772,239 |

| 53 |

Real Estate Rental and Leasing |

894,079 |

| 54 |

Professional, Scientific, and Technical Services |

2,412,470 |

| 55 |

Management of Companies and Enterprises |

79,114 |

| 56 |

Administrative and Support and Waste Management and Remediation Services |

1,654,782 |

| 61 |

Educational Services |

428,331 |

| 62 |

Health Care and Social Assistance |

1,698,635 |

| 71 |

Arts, Entertainment, and Recreation |

380,467 |

| 72 |

Accommodation and Food Services |

899,728 |

| 81 |

Other Services (except Public Administration) |

1,923,739 |

| 92 |

Public Administration |

259,259 |

What Is the Purpose of NAICS Codes?

Here are certain few examples of how your NAICS code can impact your business:

1) Be classified as a small business

The US Small Business Administration establishes size requirements for a small business. The size of your company will impact whether you are eligible for certain federal contracting opportunities. Each industry has its size standard as defined by its NAICS code. Size criteria are typically measured by average annual receipts or average employee count.

2) Obtain Small Business Financing

Certain industries, including pawn shops, political campaigns, and gambling activities, are particularly high-risk by lenders. Banks and alternative lenders will check potential business borrowers' NAICS codes to see if they fall into one of these high-risk industries. Your NAICS code might make or break your capacity to receive a small business loan from your finest lending partner!

3) Tax Advantages

NAICS codes may be used for tax purposes by federal and state authorities, and your state Tax Department may utilize them to collect and analyze tax data and prepare taxation-related reports. Your state government may use NAICS numbers to provide tax breaks to specific industries. You may miss these benefits if you use the incorrect NAICS code. More information about these options can be obtained from your accounting professional.

What Is the Distinction between a NAICS and a SIC Code?

The NAICS system replaced the Standard Industrial Classification (SIC) system in 1997. It enables statistical comparisons between enterprises in different North American countries, including Mexico and Canada. Although you may see SIC codes used by some local agencies or on corporate credit reports, the federal government no longer utilizes them. A NAICS and SIC code may appear on your business credit report.

NAICS codes provide more information about a company's activities than SIC codes. NAICS has 1,170 industries, while SIC has 1,004 industries. There are 358 new industries registered in NAICS, with 250 producing services. Furthermore, unlike SIC codes, NAICS Business Lists are based on a coherent, economic notion. Establishments that employ similar procedures to generate goods or services are classified together for NAICS numbers. The SIC codes classified industries based on either demand or production.

How to Perform a NAICS Lookup?

The NAICS website has a page where you may look for specific codes. Examine the Census Bureau's website, which publishes the NAICS Codes, or search another website. The NAICS Association offers free NAICS Code searches to people familiar with the industry to which they belong.

According to the NAICS Association, they can also assist with various other services, such as market research. If you have difficulty finding the proper code for your firm, the NAICS Association can help you at a modest cost. The Census Bureau's website is the ideal place to begin a NAICS lookup search. You can utilize online lookup tools or download the whole NAICS handbook from there. There is also a comprehensive FAQ area to find answers to your inquiries about these codes. You can utilize the 2022 NAICS code area to look up NAICS codes by keyword (e.g., publishing or transportation). Once you've identified the correct broad group or sector, you can drill down into more precise groups until you locate the 6-digit code most applicable to your company.

If you've looked at codes on that site and still aren't sure which NAICS code is best for your company, you can contact the Census Bureau for help. The NAICS Association website also provides free search and drill-down capabilities, but remember that it is a corporate website, not a government one.

Buy 100% Opt-In Job Title specific Lists

Contact Us for Marketing Campaigns

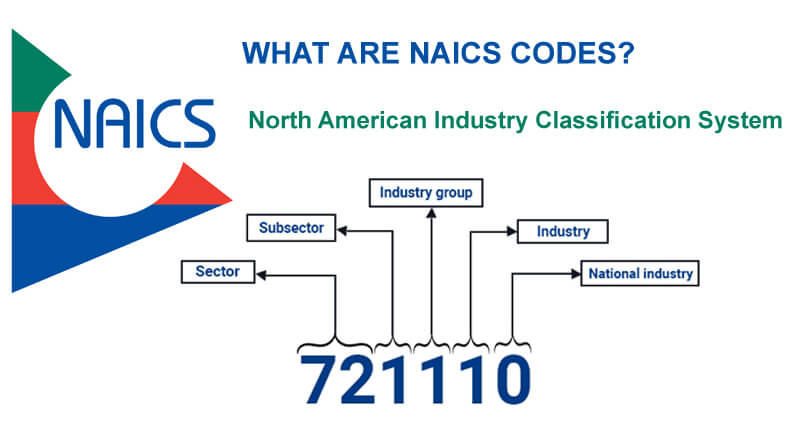

The Structure of NAICS Codes

The NAICS classification system employs a hierarchical framework. A hierarchy refers to the link of one thing to a specific group. The NAICS classification system is as follows:

- 2-digit code for sector

- 3-digit code as a subsector

- 4-digit code for the industry group

- 5- digit code for NAICS industries

- 6-digit code for national industry

A set of two-digit codes represents three sectors. Included in them are Manufacturing (31–33), Retail Trade (44–45), and Transportation and warehousing (48-49).

How to Modify Your NAICS Code?

NAICS numbers may appear insignificant, but they are critical for your firm, whether you want government contracts, financing choices, or tax breaks. Your company's NAICS number and SIC code may be listed on your business credit reports. If an inaccurate SIC or NAICS code appears on your company credit report, you must provide the exact NAICS code to the credit bureau reporting the incorrect information. They can also assist you in taking advantage of business finance opportunities by linking you to lenders, business credit cards, and other options depending on your company's data and credentials.

Is it legal to have more than one primary NAICS code?

For statistical purposes, the federal government will only utilize one NAICS code per institution. However, other systems, such as SAM, used for government contracts and awards, may allow for more than one NAICS number. Most organizations will have a major NAICS code inside SAM, but they may have many secondary NAICS numbers if they offer more than one product or service. It's also vital to recognize that some businesses may have multiple NAICS codes since they have multiple establishments, each with slightly distinct activity. Establishments and enterprises are the two basic names used to define businesses recorded by this system. A business establishment is a single physical site where business is conducted or services or industrial processes are provided (e.g., a bowling alley, coffee shop, factory, or farm). An establishment can qualify as an enterprise if it has one or more locations that are more than 50% owned by the same entity. Based on the principal business activity, an NAICS code will be assigned. The major commercial activity of the establishment is determined by the US Census Bureau based on revenues or the value of shipments.

To sum up

There are numerous reasons why a NAICS code is required. Knowing your NAICS code can make locating and applying for government grants and other incentives easier. Furthermore, many organizations use NAICS codes to identify upstream and downstream suppliers and markets. It has been created to provide a high level of comparability in business statistics between the three North American countries. The NAICS Codes Lists are built on a production-oriented paradigm, which classifies businesses into industries based on similarities in the procedures used to generate goods or services.